The ultimate pricing platform for FX derivatives.

|

Latest News

14 Nov 2024

New tools for Flxible Forwards: Exercise Boundary Map and Per-Pillar IR simulation

21 Jun 2024

Added support for Crypto (BTC, ETH)

10 May 2024

Added support for metals (XAU, XAG)

15 Feb 2024

Stateful pricing and revaluation libraries under LaaS (Libraries-As-A-Service)

Read more...

02 Oct 2023

Native multi-leg support of flexible forwards (including reservation for stochastic IR curves)

10 Sep 2023

Trading Pad with historical analysis of observed interests and axes

25 Jun 2023

New position keeping tool for arbitrary scenarios (joint bumps of surface and IR curves)

15 Apr 2023

Extension for single-name trading platform

Read more...

12 Sep 2022

New position keeping tools for exotics (digital risk, trigger de-hedge risk)

05 Mar 2021

New web-based client with white-labelling capabilities

Read more...

10 May 2020

Released export volatility surfaces via API.

Read more...

03 Nov 2019

Released Volmaster Position Keeping (Risk Management).

Read more...

15 Mar 2019

Released Volmaster SLV pricing and revaluation libraries API.

With local installation or remotely with Libraries-as-a-Service business model.

Read more...

10 May 2018

Released Volmaster historical tools as part of Volmaster FX Pricer.

Read more...

16 Nov 2017

Volmaster has entered into a strategic business relationship with Thomson Reuters (now Refinitiv). Volmaster FX Pricer App integrated into Eikon flagship platform.

Press release

12 Aug 2016

Volmaster FX used as a hands-on pricing platform in London Financial Studies (LFS) Exotic Options courses.

Read more...

19 Jul 2015

Granted a patent concerning the pricing of arbitrary instruments (via payoff-scripting) on arbitrary models (SLV and others).

Read more...

22 Feb 2014

Released Volmaster API and integration tools.

Read more...

15 Jun 2013

Volmaster has started a business relationship with MathFinance AG.

Read more...

20 Mar 2013

Implemented SLV+J pricing model (hybrid stochastic-local volatility + jumps).

13 Oct 2012

Deployed Simulation Tools.

5 Apr 2012

Introduced user-defined pricing templates.

08 Jun 2011

Released traffic/RFQ system.

Read more...

27 Mar 2011

Introduced quadratic payoffs and variance swaps.

13 Nov 2010

Implemented SLV pricing model (stochastic-local volatility).

04 March 2010

Added pre-defined option strategies.

About Volmaster FX

Now available also on Refinitiv (LSEG) Eikon platform

Volmaster has released a new edition of its acclaimed Volmaster FX Pricing App, available to users of Refinitiv (LSEG) flagship Eikon platform:

(if your browser does not correctly embed or display the video, please click on this external link)

A New Generation of Financial Software

Volmaster brings to the market community a new pricing paradigm, based on transparent and academically-backed models and capable of unrivalled speed, performance and accuracy. No black-boxes. No questionable price adjustments.

Volmaster implements several high-end features, while maintaining a simple and intuitive user interface:

- Native pricing in stochastic volatility, including 1st and 2nd order greeks

- Rich model specification, with time-dependent parameters

- Arbitrage-free volatility surfaces both in strike and in time dimensions

- Unrivaled pricing speed, massively parallel computation engine

- Wide range of exotic options coverage

- Streamlined one-click model calibration

- Flexible market datasets, mapped to your organization

- Ergonomic user interface, instant responsiveness

- Full bid/ask spread pricing, with smart netting capabilities

- Predefined and user-defined option strategies

- Advanced stripping tools, rules-based

- SingleLeg and MultiLeg pricing up to 1000 legs with multiple solvers

- Economic events volatility adjustments and automatic cut conversions

Zero-cost Infrastructure: No Servers Required, No maintenance.

Volmaster allows the financial community to perform the transition into high-end stochastic volatility pricing without the massive investments in hardware and human capital required by in-house solutions. Deployed as an on-line tool over the internet, it is always available and automatically updated. Just connect your pc to the internet and login!

By following the business model of software-as-a-service (SaaS), Volmaster delivers a fully functional solution to your desktop at a fraction of the typical cost. Volmaster is not simply a browser tool, but a virtualized and sandboxed Windows application running in your desktop. Volmaster can be integrated with your existing infrastructure, by connecting to STP solutions, streamlining the daily business and avoiding manual bookings.

Future-Proof

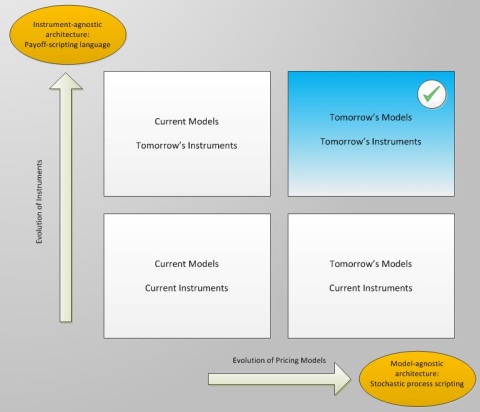

Volmaster delivers a unique pricing technology that is several order of magnitudes faster than traditional pricing methods. As our brekthrough methodology is model-agnostic, Volmaster can implement new pricing models by just providing a mathematical description of the stochastic processes, without re-coding all option classes for a particular model. The implementation of a new model propagates to all option classes automatically. As a result, Volmaster can evolve with progresses in academic research and apply new models in a very short time-frame.

Volmaster's internal open architecture can price virtually any contingent claim in the desired stochastic volatility model, including user-defined option classes. Therefore, Volmaster can help innovative firms to reduce significantly the time-to-market of new financial products.

Due to its expandability both in terms of pricing models and in terms of instrument coverage, Volmaster is a future-proof pricing platform that can satisfy the needs of the market community for future innovations of financial models and future generations of exotic options.